Search

3 Types of Budget Deficit Explained

July 31, 2017

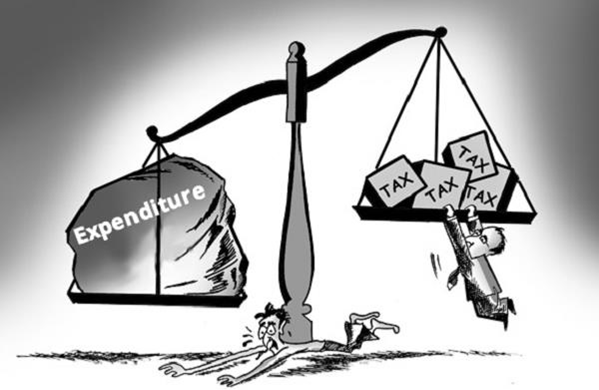

When the government starts running short on money due to increased expenses, it leads to a budget deficit. This is often a result of the government lowering the tax rates, or if the tax revenue is decreased for some other reason.

There are three main types of budget deficits, which are:

-

Revenue deficit

Revenue deficit, as the name suggests, is when the government’s income or revenue is not enough to meet the requirements of its operations and provisioning of services. It is usually represented in a percentage of the GDP.

Usually, the revenue deficit takes place when the government expends more than the generated revenue. A common solution to this is borrowing money from other nations.

-

Fiscal Deficit

Fiscal deficit takes place when total budget expenditure exceeds total budget receipts during a certain fiscal year. So, it typically reflects the amount of money the government needs to borrow for a fiscal. Standard lending options include the World Bank, Public Sector Banks, or even printing of new currency notes against government securities.

-

Primary Deficit

Major deficient is calculated by subtracting the interest payments made by the government (on the borrowed money) over a fiscal from the fiscal deficit.

The primary deficit is an indicator of the increase in the government’s debt in the current financial year as it does not take into account the debt from the previous fiscal.

In any case of a budget deficit, the government has to finance the excess expenditure from external resources. This is called deficit financing.

Important Links:

- MBA from UK University: https://ask.careers/courses/mba-from-uk-university/

- Professional Diploma in Banking and Financial Services: https://ask.careers/courses/professional-diploma-in-banking-management/

- Mumbai: https://ask.careers/cities/mumbai/

- TSCFM: https://ask.careers/institutes/tscfm/