Search

Here’s All You Need to Know about Permanent Account Number

July 31, 2017

We all know what a Permanent Account Number(PAN) is. It’s one of the most important documents to have and used by the Income Tax Department to collect and regulate the income tax. In fact, lately, its significance has increased even more as the government has made it mandatory to link your PAN to your bank accounts and your Aadhaar.

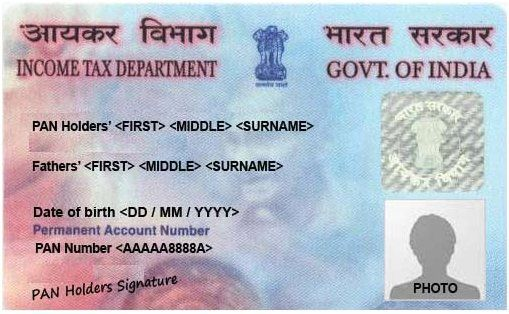

The following are some of the most important things to know about PAN:A PAN is a ten-digit alphanumeric number issued in the form of a plastic card. So, a PAN would be like this- ETBPS1105S.

- All returns of income are required to mention the relevant PAN. You also need to mention your PAN when making deposits of Rs. 50,000 or above in a bank or post office.

- From March 2, 2007, onwards, mentioning PAN is mandatory for mutual fund investments worth more than Rs. 50,000.

- No individual shall have more than one PAN. If a person is found guilty of the same, then they can be charged under the law.

- Only Form 49A can be used for making PAN applications. It can be downloaded from the NSDL website here or from the income tax website e. www.incometaxindia.gov.in.

- If the requirement of PAN is on an urgent basis, then a person can submit an application online and make a payment through a “nominated” credit card. This will facilitate the allotment process.

PAN is an important document which is used at many places. So, if you don’t have yours yet, it’s best if you apply for one immediately.