Search

Is Debt Consolidation a Good Idea?

June 15, 2017

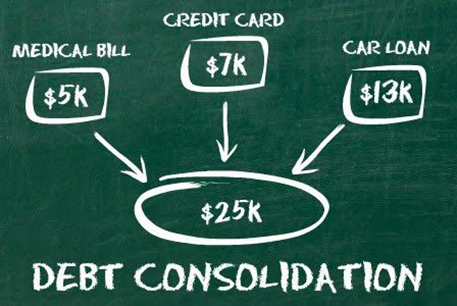

When multiple loans and debts become too overwhelming and difficult to manage you can opt for debt consolidation. In this, you take one big loan and use it for repaying the multiple debts and loans. Thus, instead of having several debts you then have just one large debt to take care of.

When is it a good idea?

Leaning towards debt consolidation is a good idea in two cases:

- Debt Management

If you have multiple loans, then it can be difficult to keep up with the repayment schedule. If there are frequent delays in the payment of EMIs or credit card bills then it can also take a toll on your credit score. Thus, in this case, you can apply for debt consolidation. With this, you will need to make a single payment per month which is easier to keep a track of.

- Lower Interest Rate

One of the biggest reasons why people opt for debt consolidation is to get an affordable interest rate. For instance, if you are using multiple credit cards and also have an unsecured home loan under your name, then the interest rate on these could be higher than a personal loan that you can get for debt consolidation. Moreover, you can also find another bank that’s offering better interest rate than your current lender, in which case too it may be a good idea to make a switch.

Debt consolidation may sound like a perfect solution for someone who is neck-deep in debt. However, if you are really going to go for it, then make sure you crunch the numbers and assess the impact of the transition beforehand. It pays to be careful when making important moves like this.