Search

Mutual Funds: How do They Work?

May 12, 2017

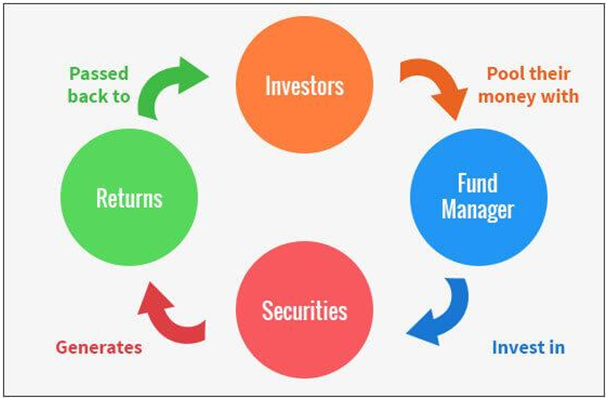

As the name suggests, a mutual fund is a collection of investments such as bonds, stocks, etc. which belong to several investors and managed by an AMC (Asset Management Company). Thus, while the funds are pooled by a lot of people, only one individual or a small group of individuals decide where to invest these funds after taking various factors into account that can maximize profits.

Usually, the mutual funds are managed by a portfolio manager, who creates and alters the investment portfolio depending on the market conditions and the objective of the investment itself.

Mutual funds have several benefits, which are:

Expert Support

Mutual funds are invested by professional finance experts who crunch all kinds of numbers and study all kinds of market fluctuations before making the investments. Thus, even though your money may not be 100% safe from market risks, you stand a good chance to make high profits.

Option to Start Small

Unlike many types of investments such as real estate, gold, etc. you don’t need a lot of money to invest in mutual fund. You can easily create a diverse portfolio for an amount as small as Rs. 5,000.

High Liquidity

There are certain investments such as bonds and fixed deposits in which your money is locked for a certain period. However, in nonrestrictive mutual fund schemes, you can easily cash your investment at any point in time.

Contrary to popular belief, mutual funds are low-risk and high-profit investments. The key is diversification and frequent portfolio checks.