Search

Things to Know about Using Cheques

May 02, 2017

In an age where digital wallets and credit cards are the most popular forms of payments, traditional means, such as cheques are gradually getting overshadowed.

However, despite the digital hype, the importance of cheques has not decreased even today. A large number of businesses still rely on cheques when large payments are involved. Thus, it pays to become familiar with the basics.

The following are the steps to write a cheque in the right way:

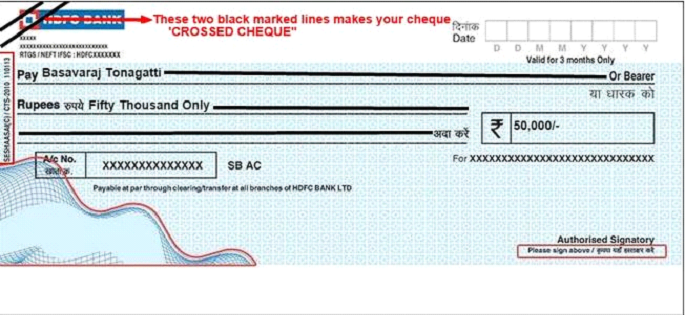

- “Cross” the cheque by drawing two parallel lines in a slanted manner at the upper left corner.

This mark means that the cheque is meant to be only deposited directly into a bank account and not be cashed by the bank.

- Enter the date in the field on the top right corner.

- Enter the name of the payee/entity and the amount you wish to pay in “words” followed by “only”. Adding “only” is just a safety measure that makes it difficult to add anything further after the amount.

- Enter the amount in numerical form and end it with the following symbol- “/-”.

- Finally, sign in the indicated portion at the bottom right corner.

What does “dishonoring a cheque” means?

A bank may refuse to clear a cheque on certain grounds such as mismatching of the amount mentioned in words and figures, or if the cheque has expired (which is usually six months), etc. This is called “dishonoring a cheque” or “bouncing”.

What happens when a Cheque “Bounces”?

When a cheque is bounced, both the payee and payer are charged by their respective banks. Frequent cheque bounces can also have a bad effect on the payer’s credit score.