Search

Things you Must Know About Demand Drafts

June 30, 2017

Even as more and more people are preferring digital payment methods such as NEFT, UPI, IMPS, etc. the traditional methods viz. cheques and demand drafts have not lost their significance. In education institutes, government offices, and many private and non-private companies Demand Drafts (DDs) are commonly used even today.

What’s a Demand Draft?

A demand draft is a pre-paid and Negotiable instrument for which the drawee (i.e. the bank) takes the responsibility of making the indicated payment when presented by the payee.

DD is often chosen over cheques in instances where the payee and drawee are unidentified and there’s a risk of bouncing.

Note: You don’t need to have an account in the bank from where you are preparing a DD. You can pay in cash for the indicated amount. However, if the amount is higher than Rs. 50,000 then you can also pay via cheque.

What are the Entries in a DD?

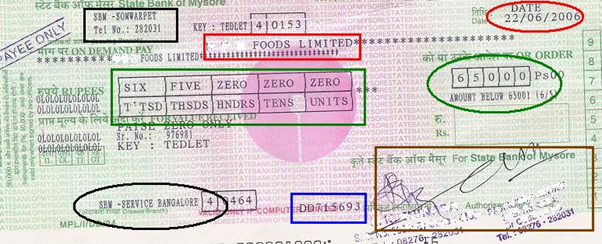

Take the following DD as an example:

The following are the typical entries in a DD:

Black Rectangle: Name of the branch that’s issuing the DD

Red Rectangle: The payee that will receive the DD funds

Red Circle: Date of Issuing the DD (it’s valid for 6 months)

Green Circle: Amount to be paid (in numbers)

Green Rectangle: Amount to be paid (in words)

Black Circle: Bank branch that will pay the DD amount

Blue Rectangle: unique DD number

Brown Rectangle: Signature of the bank officials issuing the DD

Most DD issuing banks typically charge a fee Rs. 2 to Rs. 5 per thousand of the DD amount. However, the cancellation charges are fixed and vary between Rs. 100 to Rs. 300.