Search

Understanding a Bank’s Balance Sheet

April 29, 2017

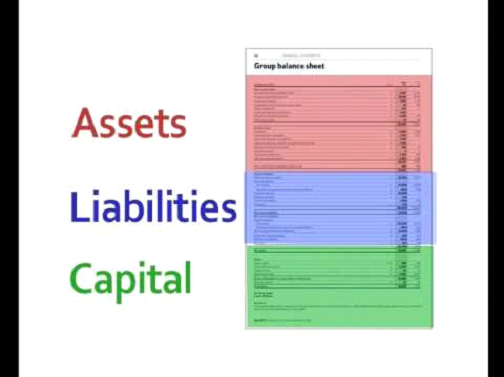

The balance sheet of a bank can be divided into two categories, which are ‘Capital and liabilities’ and ‘Assets’. These stand for the source of the funds, and the application of these funds respectively.

1. Capital and Liabilities

The section capital and liabilities can be divided into two main sub-categories:

- Net Worth: It comprises of reserves, surplus, and shared capital. Although the net worth of a bank is similar to other non-financial institutions, there are certain balances that banks have to maintain in their balance sheet, such as statutory reserve.

- Liabilities: Since banks also need funds for investing they also have liabilities. Usually, the liabilities are in the form of demand deposits, term deposits, etc. They can also borrow funds via loans, just like other non-financial companies.

2. Assets

The “assets” section describes how a bank is spending its “capital”. A bank may keep assets in various forms such as deposits made with the RBI, other investments, cash advances, etc. However, all this has to be done in compliance with RBI regulations.

Assets can also be of two types:

- Fixed Assets: This includes land, assets on a lease, etc.

- Other assets: This includes advance tax paid, interest accrued, deferred tax assets, etc.

3. The Cash Reserve Ratio

A bank also has to keep a certain amount with it to meet the withdrawal demands of its customers. The ratio of deposits that a bank has to keep with the RBI is determined by the ‘cash reserve ratio’ or (CRR), which is basically the ratio of the cash reserves and total deposits. This money is not available to the bank for any commercial activity.

Important Links:

- Professional Diploma in Banking and Financial Services: https://ask.careers/courses/professional-diploma-in-banking-management/

- Mumbai: https://ask.careers/cities/mumbai/

- TSCFM: https://ask.careers/institutes/tscfm/