Search

Understanding the Basics of CIBIL Reports

April 29, 2017

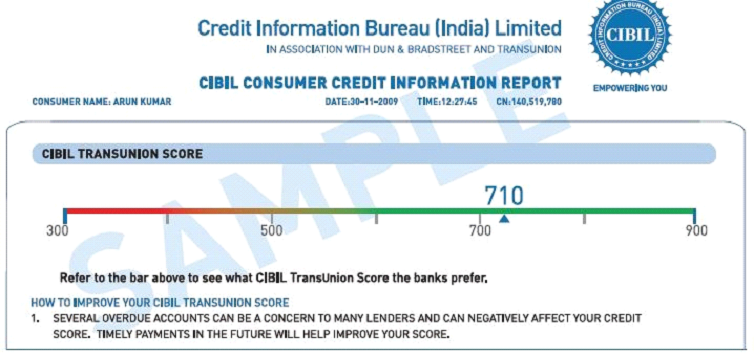

A CIBIL report, or CIR, is a document that contains the credit information of an individual. Although its most important part is the CIBIL score, which is a measure of creditworthiness, there are many other aspects that also demand attention.

A CIBIL report is divided into 5 different sections which are:

-

Personal Information

This section covers the personal details of an individual, viz. name, date of birth, gender, etc. Depending on the information provided by the person there may be other details such as their voter ID, driver’s license, passport, etc.

-

Contact Information

As the name suggests, this section contains the contact information of the individual. Typical entries include phone numbers, residential addresses, and email addresses.

This section is often referred by the bank officials for the identification of an account holder, or for verification purposes. -

Employment Information

In this section, the monthly or annual income of the applicant as disclosed by the individual is presented.

-

Account Information

This is the most important section of the CIBIL report. It includes the details of previous lenders, account numbers, types of loan taken in the past, pending debt, history of loan repayments, etc. If there are instances of “settled” loans or “written-off” balances, then they are also mentioned.

-

Enquiry Information

The inquiries made by other lenders for the CIBIL report (which is usually done when an individual applies for a loan, for the assessment of their creditworthiness) are given here. If there are multiple inquiries made in a short period, then it’s usually a bad sign.

CIBIL reports make it easy for the credit lenders to filter good loan applications from the bad ones. Thus, going through these in detail can minimize the risk of non-performing assets in the future.