Search

What’s the FRDI Bill? Why are People Concerned About it?

December 11, 2017

The Financial Resolution and Deposit Insurance (FRDI) Bill, 2017 is expected to provide a comprehensive resolution framework for the bankruptcy issues in banks and other financial sector entities along with the insurance companies.

According to the government’s statement, the bill also aims at the strengthening of the deposit insurance framework that will benefit a large segment of the retail depositors.

The History of FRDI

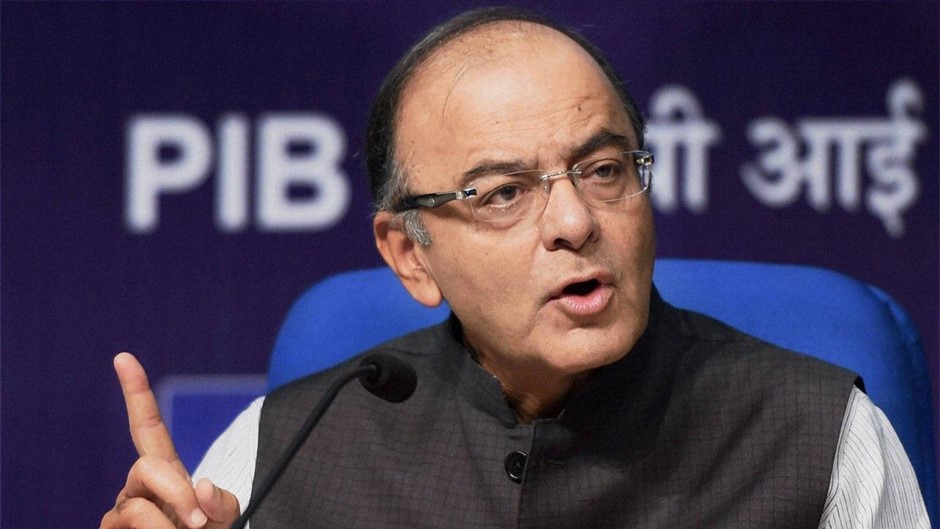

The bill was introduced for the first time by the current finance minister Arun Jaitley during his 2016-17 budget speech when he said that a “systemic vacuum exists with regard to bankruptcy situations in financial firms” and announced that a comprehensive framework regarding the same would be tabled in the parliament during 2016-17.

Materializing the declaration, the union cabinet recently approved the proposal to roll out a Financial Resolution and Deposit Insurance (FRDI) Bill. A report on the same is also expected to be submitted by the Joint Committee of Parliament in the upcoming winter session of Parliament that begins on December 15.

What’s the Controversy All About?

The FRDI has become a hot topic of discussion among the youth, especially on the social media, mainly because of a particular clause in the bill which could allow the banks to use the money of its customers (depositors) to bail themselves out in an event of bankruptcy.

In fact, an online petition was recently started by Mumbai-based Shilpa Shree against the proposed FRDI Bill. In mere 24 hours, it was able to get more than a whopping 40,000 signatures.

Learning about the kind of attention the bill was getting, finance minister Arun Jaitley decided to clear the air by saying that contrary to the claims by the opposition parties, which include references to the bill as “anti-poor”, the union government is committed to protecting the interest of the depositors. He also dismissed the reports on the potential dilution of the bill.