Search

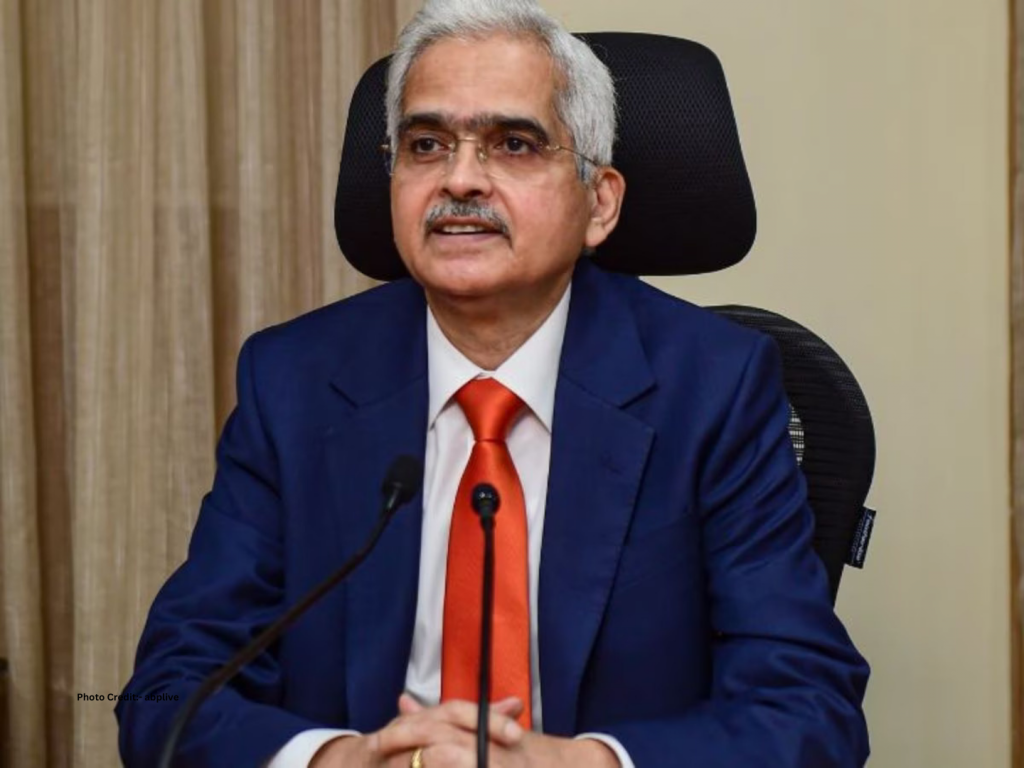

Indian banking system stable, RBI governor

May 24, 2023

Reserve Bank of India Governor Shaktikanta Das Wednesday said though inflation has moderated, there is no room for complacency.

The consumer price-based inflation (CPI) eased to 4.7 per cent in April from 5.7 per cent in March.

“The war on inflation is not over. We have to remain alert. There is no cause for complacency, especially since we have to see how the El Nino factor plays out,” Das said, while addressing the CII’s annual session.

Das said he is confident that the country will be able to record a growth close to 6.5 per cent in FY2024.

For FY2023, he said the estimates are that the GDP growth will be 7 per cent, but there is a possibility that it could be even more.

According to all the recent trends, it will not be a surprise if the GDP growth for the last year (FY23) comes slightly above 7 per cent but let us stick to 7 per cent for the time being,” Das said.

He said capacity utilisation in the manufacturing sector continues to be robust and credit offtake in banks also remains quite resilient.

The Governor said the RBI’s endeavour is to remain prudent and proactive in its actions to ensure financial stability.

Important Links:

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://ask.careers/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/

- Mumbai: https://ask.careers/cities/mumbai/

- TSCFM: https://ask.careers/institutes/tscfm/