Search

Private Banks See Rising IT Expenses Amid Digital Transaction Surge

April 29, 2024

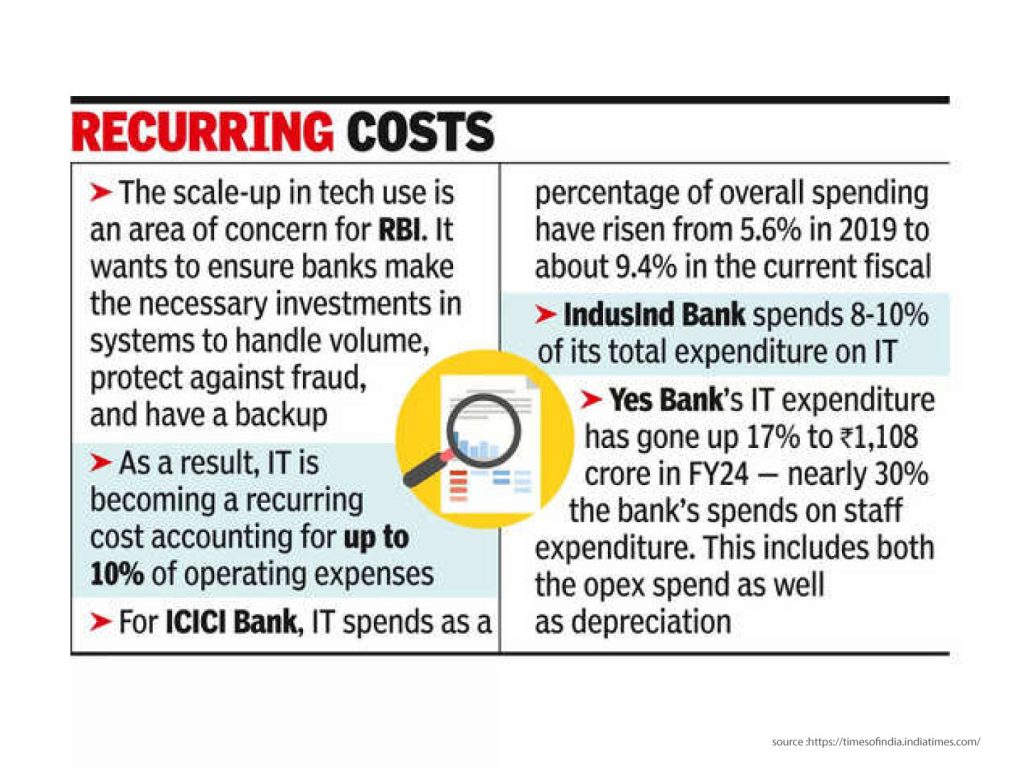

Private banks are facing a significant increase in information technology (IT) expenses due to the growing prevalence of digital transactions. Unlike the one-time capital expenses incurred during the migration to core banking systems, IT costs have become recurring, accounting for up to 10% of operating expenses.

Responding to queries following RBI’s action on Kotak Mahindra Bank, bankers emphasized that IT investments are ongoing and essential for maintaining capabilities.

Previously, technology merely automated manual tasks, but now investments cover handling billions of monthly transactions, integrating with other businesses, leveraging analytics for targeted sales, and employing artificial intelligence for customer service.

The Reserve Bank of India is concerned about the scale-up of technology usage and insists that banks invest adequately to handle transaction volumes, prevent fraud, and ensure backup systems.

Sandeep Batra, Executive Director of ICICI Bank, highlighted that IT and cybersecurity spending has risen from 5.6% to 9.4% of overall spending. However, he noted that the rate of growth in tech expenses would moderate.

Sumant Kathpalia, MD & CEO of IndusInd Bank, mentioned that 8-10% of total expenditure is allocated to IT, with ongoing evaluation by a board-level committee. Yes Bank reported a 17% increase in IT expenditure to Rs 1,108 crore in FY24, nearly 30% of staff expenditure, emphasizing a focus on technology, information security, and future infrastructure.

Subrat Mohanty, Executive Director at Axis Bank, emphasized investments to handle digital transaction surges while ensuring system resilience and data security. He highlighted the importance of a strong technology architecture to manage core banking, middleware, and frontend systems effectively.

Important Links:

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://ask.careers/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/

- Mumbai: https://ask.careers/cities/mumbai/

- Indore: https://ask.careers/cities/indore/

- TSCFM: https://ask.careers/institutes/tscfm/