Search

Transaction limit for small value payments in offline mode raised

August 25, 2023

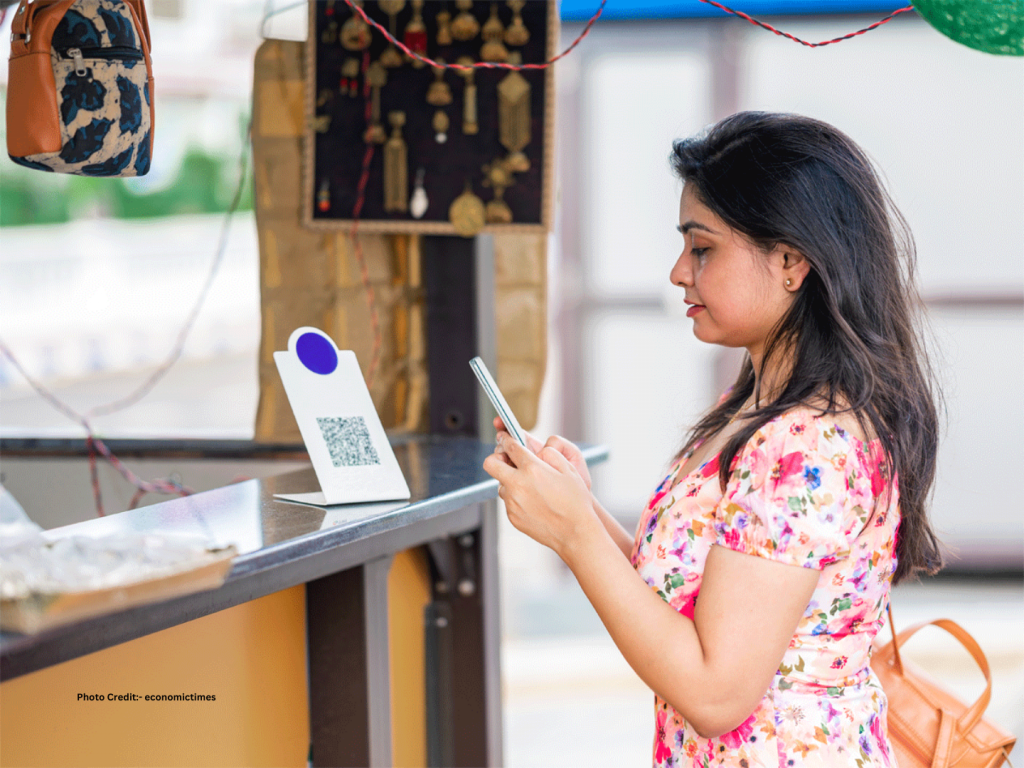

The Reserve Bank on Thursday enhanced the upper limit of an offline payment transaction to ₹500 from the existing ₹200 to promote the use of UPI-Lite wallet in areas where internet connectivity is weak or not available.

However, the total limit for offline transactions on a payment instrument remains ₹2,000 at any point in time.

“The upper limit of an offline payment transaction is increased to ₹500,” the RBI said in a circular on ‘Enhancing transaction limits for Small Value Digital Payments in Offline Mode’.

To increase the speed of small-value transactions on UPI, an on-device wallet called UPI-Lite was launched in September 2022 to optimise processing resources for banks, thereby reducing transaction failures.

The product has gained traction and currently processes more than 10 million transactions a month.

Earlier this month, the RBI had proposed to facilitate offline transactions using Near Field Communication (NFC) technology to promote the use of UPI-Lite. Transactions through NFC do not require PIN verification.

It had said this feature will not only enable retail digital payments but also ensure speed, with minimal transaction declines in situations where internet or telecom connectivity is weak or not available.

Important Links:

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://ask.careers/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/

- Mumbai: https://ask.careers/cities/mumbai/

- TSCFM: https://ask.careers/institutes/tscfm/