Search

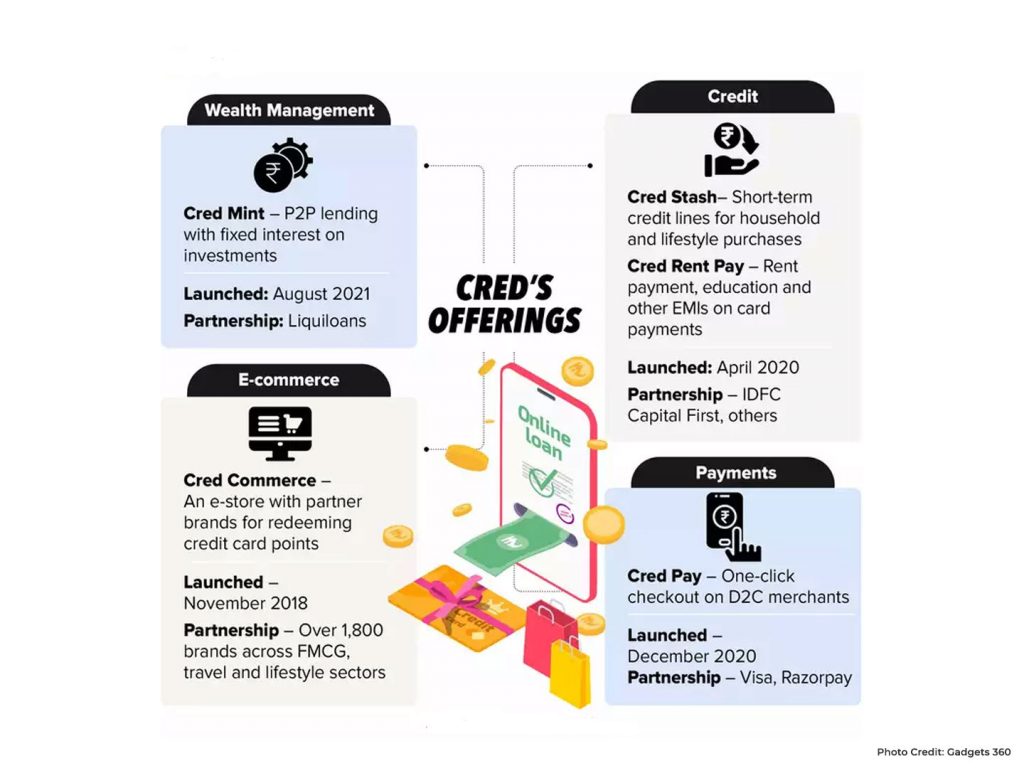

Cred to enter peer-to-peer lending with user funds

August 20, 2021

“While we were studying client conduct on our foundation, we realized that large numbers of our individuals have lakhs in savings lying idle in their financial balance, accruing interest rates which don’t beat inflation,” said Shah. “This is an erosion of wealth and as a community of high trust individuals we felt that P2P lending offers a low-risk investment opportunity for a Cred investing into future.”

Important Links:

- 3-IN-1 Management Program: https://ask.careers/courses/3-in-1-management-program/

- Mumbai: https://ask.careers/cities/mumbai/

- TSCFM: https://ask.careers/institutes/tscfm/