Search

Government's High Cash Balances Strain Banks During Elections

May 27, 2024

The ongoing general elections have resulted in a unique challenge for the government: while its cash balances are higher than in previous Lok Sabha polls, spending restrictions have left banks short of funds as the Centre tries to avoid letting money sit idle.

Efficient fund management, strong tax collections, and states building up cash have led to government cash balances exceeding ₹3 lakh crore, reducing available funds in the banking sector.

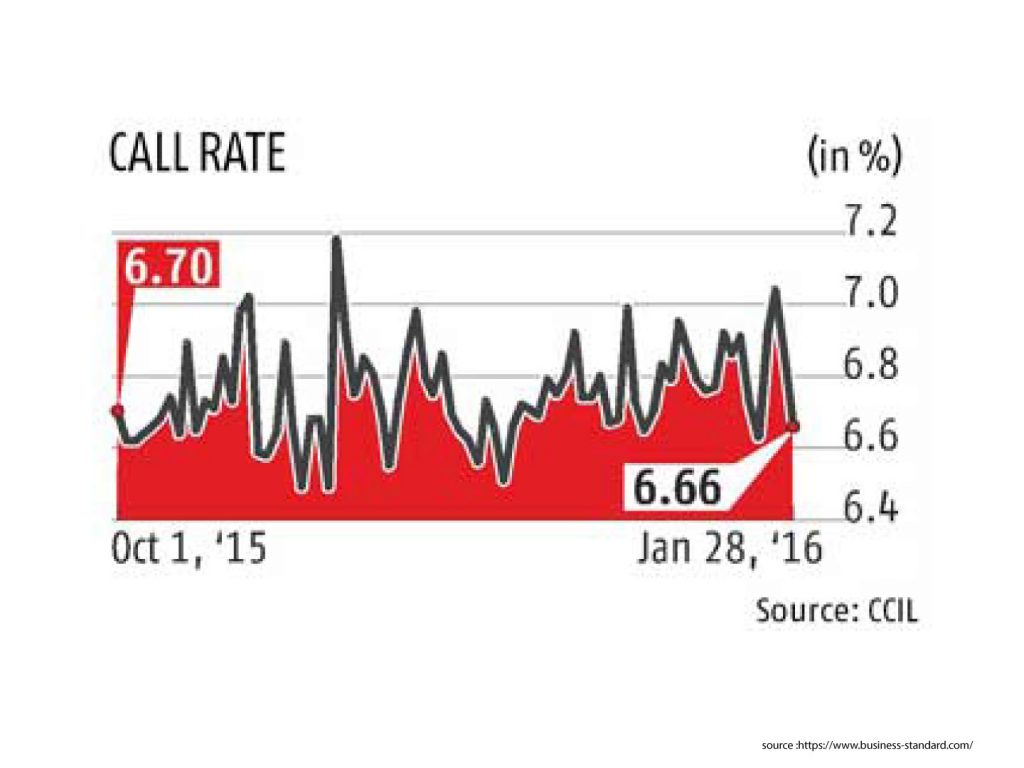

Due to spending limits during the lengthy election period, government spending—which typically flows through banks—has slowed, causing a tight money market and higher borrowing costs.

“Government cash surplus—Centre plus states—is currently ₹2.5 lakh crore as of May 17, significantly higher than ₹1.4 lakh crore on May 19, 2023,” said Gaura Sengupta, chief economist at IDFC First Bank. “In the last general election year, FY20, the surplus was only ₹40,000 crore as of May 17, 2019.”

Recent goods and services tax (GST) collections have likely pushed cash balances past ₹3 lakh crore. In contrast, after the 2014 general elections, the Centre and states had a cash deficit of ₹94,000 crore, indicating high government spending at the time.

The government’s adoption of ‘just-in-time’ cash management has improved efficiency but left banks without the large liquidity floats they previously enjoyed, as funds are now released on the specified date rather than weeks in advance.

“Better cash management by the Centre through ‘just-in-time’ practices for scheme expenditures has contributed to the large cash surplus,” Sengupta added.

The Reserve Bank of India (RBI) has noted that government spending fluctuations significantly impact bank liquidity. From May 1 to May 23, the daily average deficit liquidity, measured by banks’ borrowing from the RBI, was ₹1.4 lakh crore.

To address this, the RBI has conducted several liquidity infusion operations, while the government has attempted, largely unsuccessfully, to buy back outstanding bonds to use its cash balance and reduce interest costs.

In 2021, the government introduced the Single Nodal Agency (SNA) model for cash management, setting up SNA accounts with banks for central sector and centrally sponsored programs. Now, it has moved towards the SNA SPARSH model, aiming for just-in-time fund releases for these programs.

Important Links:

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://ask.careers/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/

- Mumbai: https://ask.careers/cities/mumbai/

- Indore: https://ask.careers/cities/indore/

- Pune: https://ask.careers/cities/pune/

- Ahmedabad: https://ask.careers/cities/ahmedabad/

- TSCFM: https://ask.careers/institutes/tscfm/