Search

HDFC Bank MD Prioritizes Stability Over Immediate Growth, Post-Merger Transition in Focus

May 07, 2024

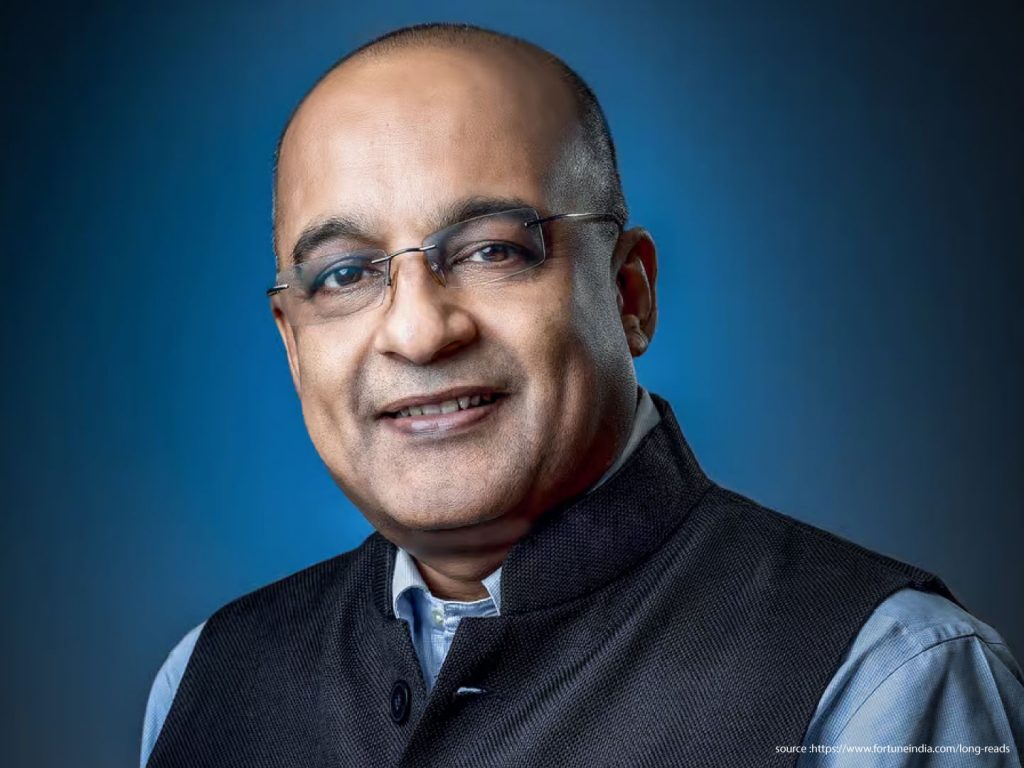

In a recent statement, HDFC Bank’s managing director, Sashidhar Jagdishan, emphasized the importance of stability and patient growth strategies following the bank’s merger with parent institution Housing Development Finance Corporation (HDFC) last July.

Speaking after the bank’s fourth-quarter results announcement, Jagdishan stated that HDFC Bank will not aggressively pursue growth purely for the sake of expansion. Instead, he expressed contentment with maintaining current margins, highlighting a positive bias towards steady growth over the next two to three years.

Jagdishan acknowledged the ongoing transition phase post-merger, likening it to the construction of Mumbai’s coastal road. He assured investors of eventual benefits, equating to smoother operations once the transition period concludes.

“We will have our day when borrowing levels decrease,” Jagdishan remarked optimistically. He stressed the bank’s commitment to stability in profitability metrics during this period while aiming for a positive growth trajectory in the coming years.

Before the merger, HDFC Bank’s margin ranged from 4.1% to 4.3%, which subsequently adjusted to 3.4% to 3.6% post-merger.

Despite a recent 8% decline in the bank’s shares, HDFC Bank retains its position as the most valued bank in terms of market capitalization, amounting to ₹11.6 lakh crore.

Jagdishan’s comments underscore HDFC Bank’s strategic shift towards sustainable growth amid a transitional phase, prioritizing stability and profitability metrics while navigating through the merger’s impact on operations and future prospects. Investors are encouraged to exercise patience and maintain a long-term outlook as the bank progresses through this transformative period.

Important Links:

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://ask.careers/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/

- Mumbai: https://ask.careers/cities/mumbai/

- Indore: https://ask.careers/cities/indore/

- Pune: https://ask.careers/cities/pune/

- Ahmedabad: https://ask.careers/cities/ahmedabad/

- TSCFM: https://ask.careers/institutes/tscfm/