Search

RBI Expected to Maintain Repo Rate at 6.50% in Upcoming MPC Meeting

April 03, 2024

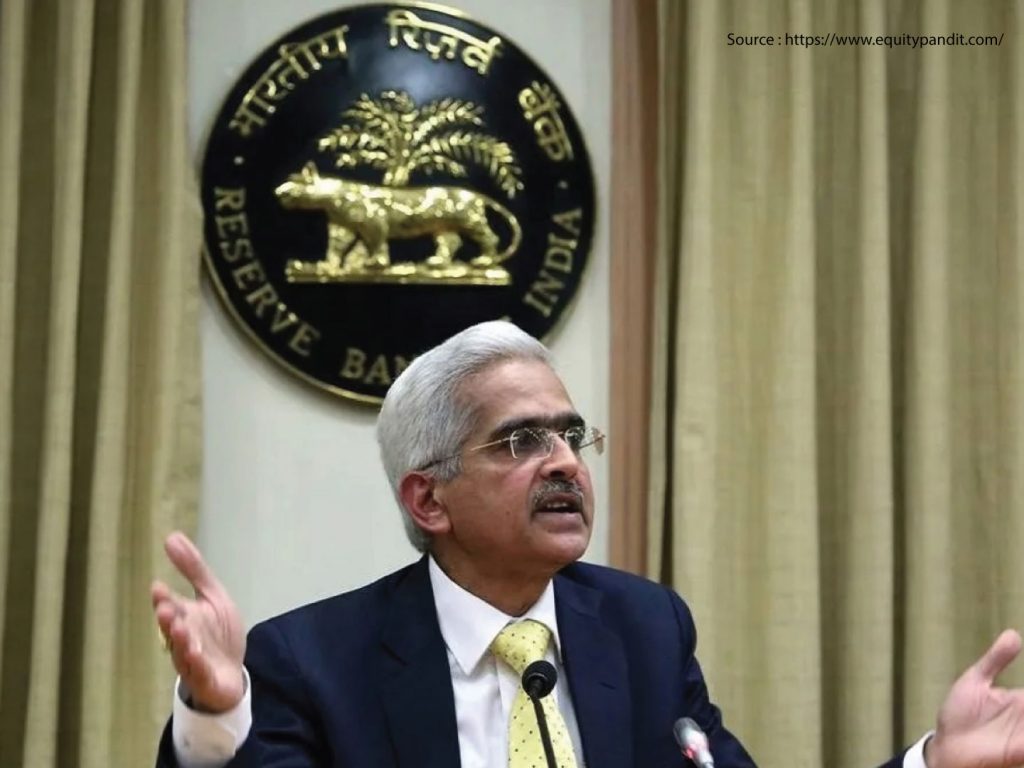

The Reserve Bank of India (RBI) is set to hold its Monetary Policy Committee (MPC) meeting from April 3 to 5, where it is expected to decide on the repo rate, keeping it steady at 6.50 per cent.

Most members of the MPC are likely to vote for maintaining the status quo, aligning with the RBI’s goal of keeping retail inflation around four per cent.

In the previous financial year (FY24), the RBI held the repo rate unchanged in all six bi-monthly monetary policy reviews due to high retail inflation exceeding the committee’s target. The last change to the repo rate happened in February 2023, when it was raised from 6.25 per cent to 6.50 per cent.

While economists anticipate the RBI to continue its stance of ‘withdrawal of accommodation,’ there is speculation about a potential shift to a ‘neutral’ stance, which could pave the way for rate cuts later in FY25.

RBI Governor Shaktikanta Das emphasized the need for ongoing vigilance to address inflationary pressures in his recent monetary policy statement.

Looking ahead, inflation projections suggest a decrease until July, followed by a rise peaking at 5.4 per cent in September, before slowing down. For FY25, CPI inflation is expected to average 4.5 per cent.

Amid global economic uncertainties and domestic inflation pressures, the upcoming MPC meeting holds significant implications for monetary policy and its impact on the broader economy.

Important Links:

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://ask.careers/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/

- Mumbai: https://ask.careers/cities/mumbai/

- Ahmedabad: https://ask.careers/cities/ahmedabad/

- Indore: https://ask.careers/cities/indore/

- Pune: https://ask.careers/cities/pune/

- TSCFM: https://ask.careers/institutes/tscfm/