Search

RBI is ownership neutral, on bank privatisation

August 24, 2022

The central bank in its latest monthly bulletin featured an article produced by its researchers said that a gradual approach to privatisation could help achieve the broader social objective of financial inclusion, the paper had said, seeking to underscore the role of state-run lenders in taking formal banking to the under-banked.

Owing to some furore and rumours in the market, the RBI issued a clarification saying that it is not against the privatisation of banks. “The researchers are of the view that instead of a big-bang approach, a gradual approach as announced by the government would result in better outcomes,” the central bank said as part of its clarification.

The paper argued that while private sector lenders are more efficient in profit maximisation, public sector banks have scored better at promoting financial inclusion, delivering farm loans and achieving monetary transmission-key objectives of both the government and the RBI. The government had announced plans to privatise two state-owned banks in the FY22 budget.

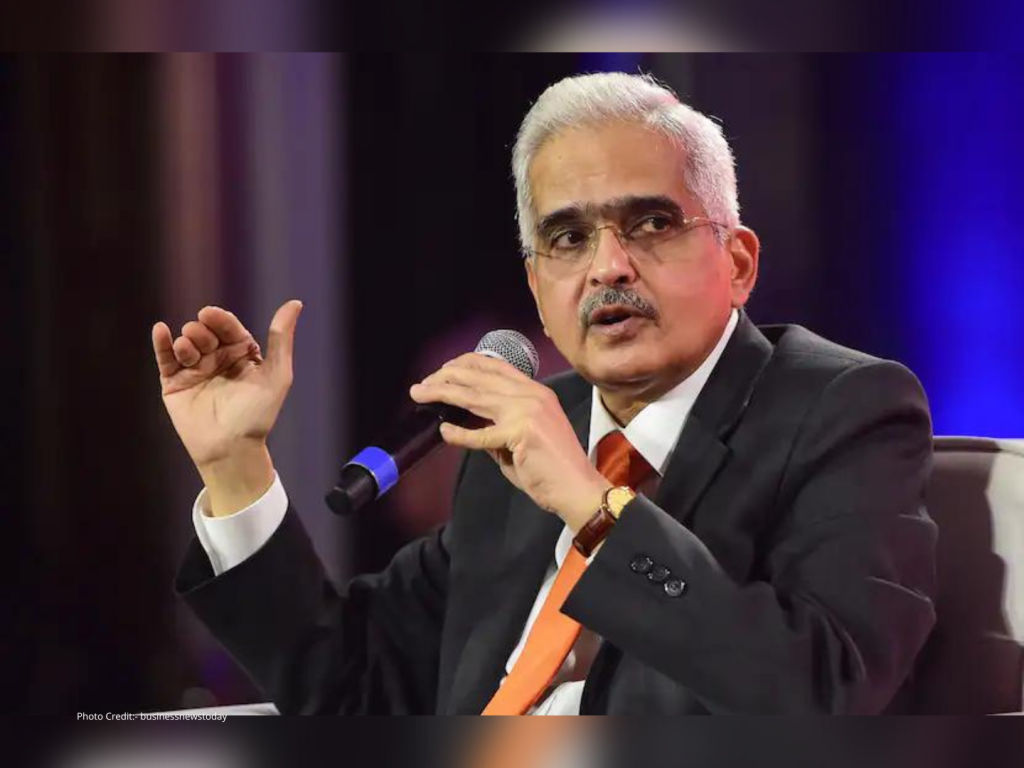

“We prescribe certain regulatory guidelines and it is our job to ensure that those regulatory guidelines are adhered to and the banking sector functions in an orderly manner in a well-regulated manner, banks are robust, they are well capitalised, their financial parameters should be strong so we are agnostic to ownership, we are ownership neutral,” Das clarified once again.

Important Links:

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://ask.careers/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/

- Mumbai: https://ask.careers/cities/mumbai/

- TSCFM: https://ask.careers/institutes/tscfm/