Search

RBI Remains Vigilant to Safeguard Financial Stability Amidst Lending Risks

December 29, 2023

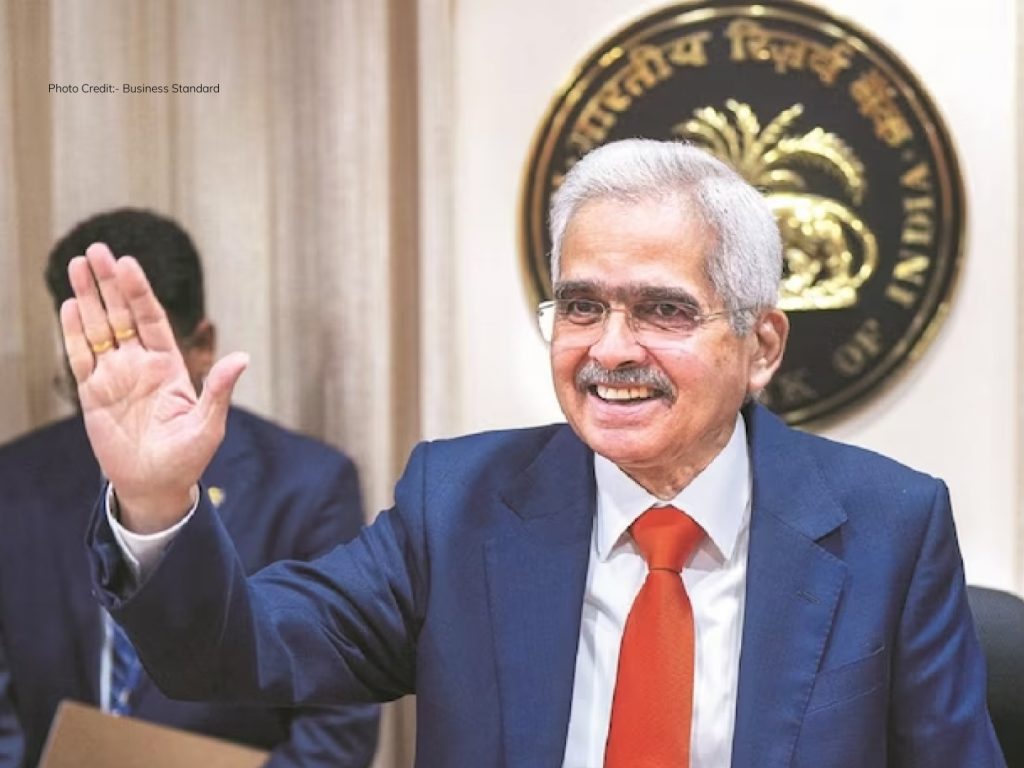

In a recent statement on Thursday, Reserve Bank of India (RBI) Governor Shaktikanta Das affirmed the central bank’s readiness to take early and decisive actions to mitigate any emerging risks. The governor highlighted that recent measures aim to ensure financial stability without hindering the flow of funds essential for the economy.

Das emphasized the commitment to balance financial stability and the availability of funds for productive needs. The RBI’s half-yearly Financial Stability Report outlined concerns, including a rise in risk profiles for consumer and personal loans, deteriorating underwriting standards, and an increase in overdue personal loans for certain borrowers. Despite these challenges, Das noted positive trends in the financial system. Earnings are at multi-year highs, stressed assets remain low, and financial institutions boast robust capital and liquidity buffers.

The governor stressed the need to consolidate gains made since the onset of the COVID-19 pandemic, aiming for a higher growth trajectory with economic and financial stability.

RBI’s stress analysis projected a potential improvement in the gross non-performing asset (GNPA) ratio by September 2024. However, under adverse scenarios, the GNPA ratio could increase, with state-owned banks experiencing a maximum decline in bad loan ratios.

The report also highlighted a notable decrease in gross bad loans, reaching an 11-year low at 3.2%. Stress tests indicated that banks maintain sufficient capital buffers to withstand adverse scenarios.

Governor Das reassured that the RBI remains dedicated to fortifying the financial system, fostering responsible innovation, and supporting inclusive growth. Despite global challenges such as technological disruptions, cyber risks, and climate change, the focus remains on preserving financial stability.

A systemic risk survey conducted by RBI in November indicated stable or reduced risk perceptions across major categories, except for macroeconomic risks. Confidence in the stability of the Indian financial system remained high, contrasting with declining confidence in the global financial system.

As 2023 concludes, challenges persist, including slow global growth, elevated debt levels, and geopolitical tensions, but the RBI remains committed to navigating these uncertainties.

Important Links:

- Professional Diploma in Banking and Financial Services: https://ask.careers/courses/professional-diploma-in-banking-management/

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://ask.careers/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/

- Mumbai: https://ask.careers/cities/mumbai/

- Indore: https://ask.careers/cities/indore/

- Ahmedabad: https://ask.careers/cities/ahmedabad/

- Pune: https://ask.careers/cities/pune/

- TSCFM: https://ask.careers/institutes/tscfm/